Money Avoidance: Meaning, Definition, and What Is Money Avoidance in Everyday Life

Money Avoidance: Why Some People Stay Away From Their Finances

Money avoidance is a pattern many people live with without knowing its name. If you have ever searched for money avoidance meaning, what is money avoidance, or looked up a simple money avoidance definition, you are not alone. The term describes something very real: the habit of staying away from money matters because they feel uncomfortable. Some people even wonder whether there is a money avoidance disorder. While it is not a medical diagnosis, it is a powerful behavior pattern that can quietly affect everyday life.

Money avoidance does not always look dramatic. It can look normal on the outside. A person may earn regularly, pay bills most of the time, and still feel uneasy whenever finances are mentioned. The avoidance is emotional before it is financial.

What Is Money Avoidance?

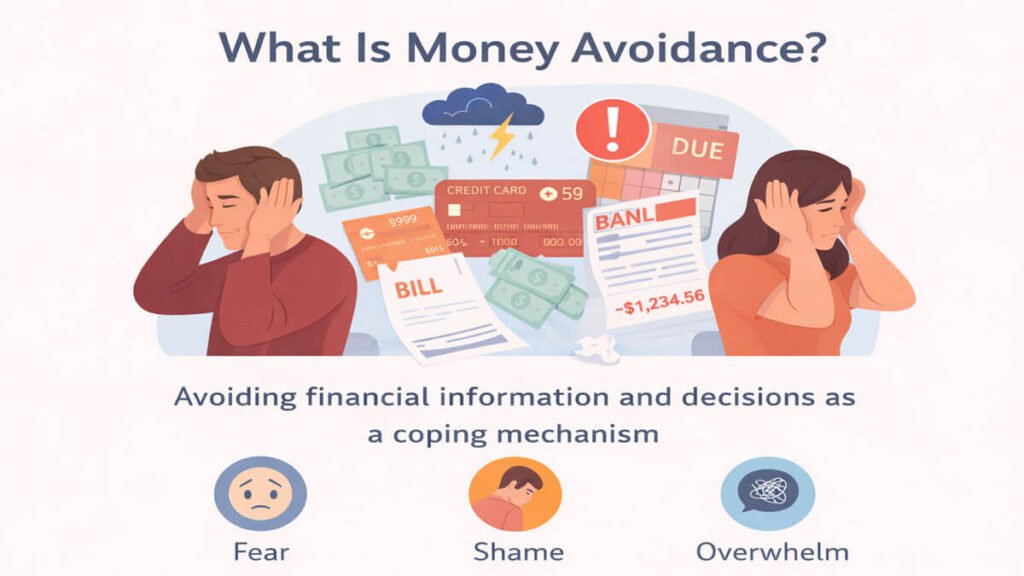

Now, let’s answer the most basic question clearly: What is money avoidance? It is the repeated action of ignoring, putting off, or escaping money-related responsibilities because they cause stress, fear, or discomfort. Instead of looking at a bank account, a person might say, “I’ll do it tomorrow.” Instead of planning expenses, they might trust that “things will work out.”

Avoidance gives short-term relief. When you don’t look at your balance, you don’t feel worried. When you postpone a financial decision, you don’t feel pressure. But this relief does not last. The bills remain. The numbers do not disappear. The only thing that grows is anxiety.

Money avoidance is rarely about laziness. It is usually about emotion. Money connects deeply to safety, self-worth, and identity. When these feel threatened, the mind tries to protect itself by turning away.

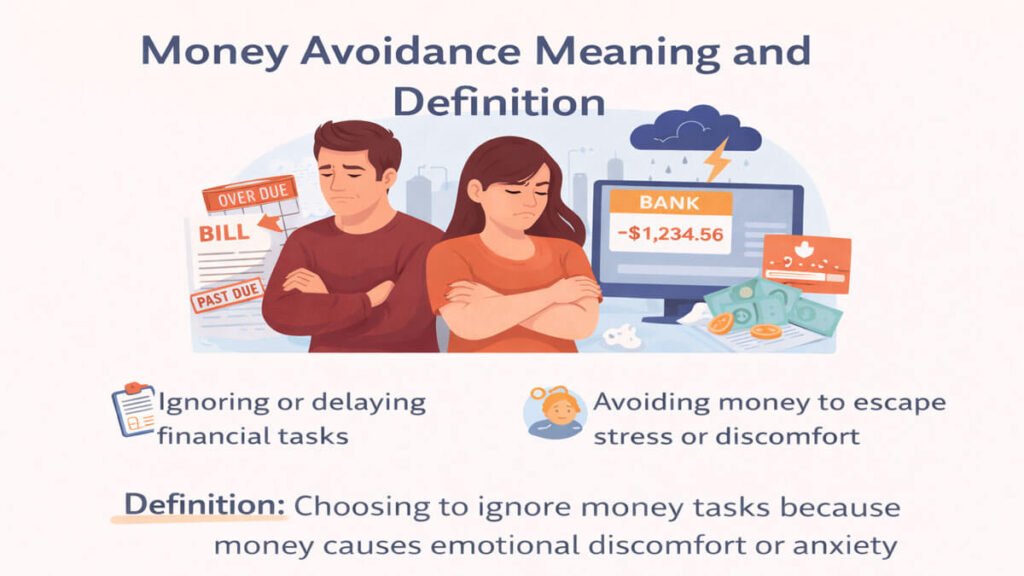

Money Avoidance Meaning and Definition

The money avoidance meaning is simple: creating distance from financial reality because facing it feels hard. A possible definition of money avoidance could be the following: “A behavior pattern in which an individual avoids looking at, thinking about, or dealing with money because of emotional discomfort.”

This discomfort may arise from a number of sources. Maybe the person has a history of financial instability and therefore equates money with fear. Maybe the person has made some errors in the past and is therefore embarrassed by their financial choices. Maybe the person was raised as a child to believe that money is dirty or greedy.

Money avoidance does not depend on income level. A person with a high salary can still avoid looking at investments. A student can avoid tracking expenses. A business owner can avoid reviewing profit numbers. The common factor is not income. It is emotion.

Everyday Signs of Money Avoidance

Money avoidance often hides in daily habits. One sign is avoiding bank notifications. If you see a message from your bank and feel a knot in your stomach, that reaction matters. Another sign is postponing bill payments even when funds are available. The delay is not about money; it is about avoiding discomfort.

Some people never check how much they spend in a month. They swipe cards without looking at totals. Others avoid conversations about finances with partners because they fear conflict. In relationships, this can slowly build tension.

There is also a quieter version of avoidance. A person may tell themselves that planning is unnecessary. They may say, “I don’t need a budget” without truly examining their habits. This subtle denial protects them from facing uncertainty. Over time, this pattern can become one of the most common bad money habits without the person realizing it.

Is Money Avoidance a Disorder?

When people search online, they sometimes type “money avoidance disorder.” It is necessary to note that money avoidance is not considered a medical issue. However, it can be associated with anxiety, stress, or trauma related to money.

If a person experiences panic when thinking about opening a bank statement or avoids the issue of debts altogether, it can be associated with emotional issues. In this case, professional help is required. A therapist or financial advisor can assist a person in identifying the reasons.

The important thing to note is that it is less important to consider the behavior a disorder than to identify the reasons for the behavior. Avoidance is a coping mechanism. It is developed to shield us from emotions that we do not want to confront.

The Money Avoidance Script

Many psychologists speak about money scripts. These are silent beliefs about money that guide behavior. An example of a money avoidance script might be: “I’m not good with money,” “Money causes problems,” or “It’s uncomfortable to talk about money.”

These scripts tend to begin in childhood. If the child sees a lot of arguing about money in their home, they might think that money and arguing are the same thing. If the parents in their home never discussed money, then discussing money might be off-limits.

The script runs quietly. You may not hear it clearly, but it influences choices. When a financial task appears, the script activates and says, “Stay away.” Over time, this pattern feels natural.

Changing a money avoidance script begins with noticing it. Ask yourself what you believe about money. Write it down. Then question whether that belief is still true. Many of our beliefs are old stories that no longer serve us.

Why Avoiding Money Feels Easier

Avoidance seems like the easier option because it doesn’t add stress to the present moment. The human brain favors the comfort of the present. Confronting financial reality can mean fear of loss, fear of not having enough, or fear of being judged. Avoidance seems like the safe option.

Shame is a big player in this situation. If an individual has regrets about past spending or debt, viewing the current situation can bring those feelings back. Therefore, the mind selects silence. Silence maintains the shame. While some people cope with difficult emotions through emotional spending, others cope by turning away from money completely.

There is also the element of overwhelm. Today’s finances include loans, investments, insurance, and online transactions. If the individual is uncertain about these systems, avoidance seems less draining than learning more about them.

How Money Avoidance Impacts Life

The effects of money avoidance go beyond numbers. Financial uncertainty can disturb sleep. It can create tension in relationships. It can limit future plans. When someone avoids looking at their finances, they also avoid making informed decisions.

A person who does not track expenses may miss chances to save. Someone who avoids negotiating salary may remain underpaid. A business owner who ignores financial reports may miss warning signs. In contrast, some people respond to financial stress through compulsive spending rather than avoidance.

Emotionally, avoidance reduces confidence. Facing money builds clarity. Ignoring it builds doubt. Over time, this doubt affects overall self-esteem.

Money avoidance can also create dependence. If one partner in a relationship handles all finances while the other avoids involvement, imbalance grows. Shared responsibility builds stability, while avoidance creates distance.

Gentle Ways to Break the Pattern

Breaking money avoidance does not require extreme action. In fact, small steps are more powerful. Begin with awareness. Notice your reaction when money is mentioned. Is it tension? Is it irritation? Simply observing your emotion is the first step.

Next, start small. Check your bank balance without judgment. Do not analyze deeply at first. Just look. Repeat this regularly until the fear reduces. Gradual exposure builds comfort.

Set simple routines. Pick one day a week to check your spending. Keep it brief. Regularity is more important than intensity.

It is also helpful to work on your internal monologue. Change “I dislike handling money” to “I am learning to handle money calmly.” Language has a bigger impact on behavior than people think.

If avoidance is very ingrained, talking to a professional can help sort it out. Support does not equal weakness. It means willingness to grow.

Final Thoughts

Money avoidance is not a sign of failure. It is a sign of unresolved emotion. Understanding what is money avoidance, knowing the true money avoidance meaning, and applying a realistic money avoidance definition can bring clarity. While some may search for money avoidance disorder, the deeper truth is that avoidance is a habit shaped by experience.

Facing finances may feel uncomfortable in the beginning. But with each small step, discomfort turns into confidence. Money does not become less important when ignored. It becomes less frightening when understood.

FAQs

What leads to money avoidance behavior?

Money avoidance behavior is normally a result of emotional discomfort and not a lack of knowledge. People normally avoid money because money is associated with fear, shame, guilt, or unpleasant memories. Childhood experiences, money problems, or witnessing disagreements about money during childhood can lead to such emotional responses. If money is emotionally burdensome, the mind resorts to the strategy of avoidance. This becomes an automatic response over time.

How can you overcome money avoidance behavior?

Overcoming money avoidance behavior requires taking small steps. Rather than attempting to solve all the problems at once, you can begin by checking your bank account or looking at one week’s worth of spending. The aim is to develop familiarity with money. Another approach is to examine your money beliefs and determine whether they are still valid.

Rajat Sharma writes about human behaviour, money habits, and the quiet patterns that shape everyday decisions. Through simple, reflective writing, he explores why we think the way we do — from emotional spending to productivity and personal growth. His goal is not to give rigid advice, but to help readers notice the subtle habits that influence their lives.