Bad Money Habits We Don’t Notice Until Life Starts Feeling Tight

Bad Money Habits

Usually, bad money habits are not the result of bad money skills. Rather, they begin as normal and pleasant habits that are easy to develop and repeat daily. Sometimes bad money habits, such as bad financial expenditure and bad money spending, become a normal routine that does not solicit an iota of question. Subsequently, bad money habits lead to changes in savings, peace of mind, and relationships. While the write-up is not about regulations or pressures, let us dig deeper into bad money habits with new insights into how to break bad money habits.

Bad Spending Habits

Bad spending habits usually stem from emotions instead of logic. For instance, people actually spend their money merely out of tiredness, stress, boredom, or even the need to feel a little better. These bad habits do not seem damaging at the time they take place. However, the accumulation of these habits over time transforms them into bad habits concerning the outflow of money.

Some bad spending habits that quietly become part of daily life are:

• Buying things to change mood without thinking about tomorrow

• Making frequent small purchases because they seem cheap

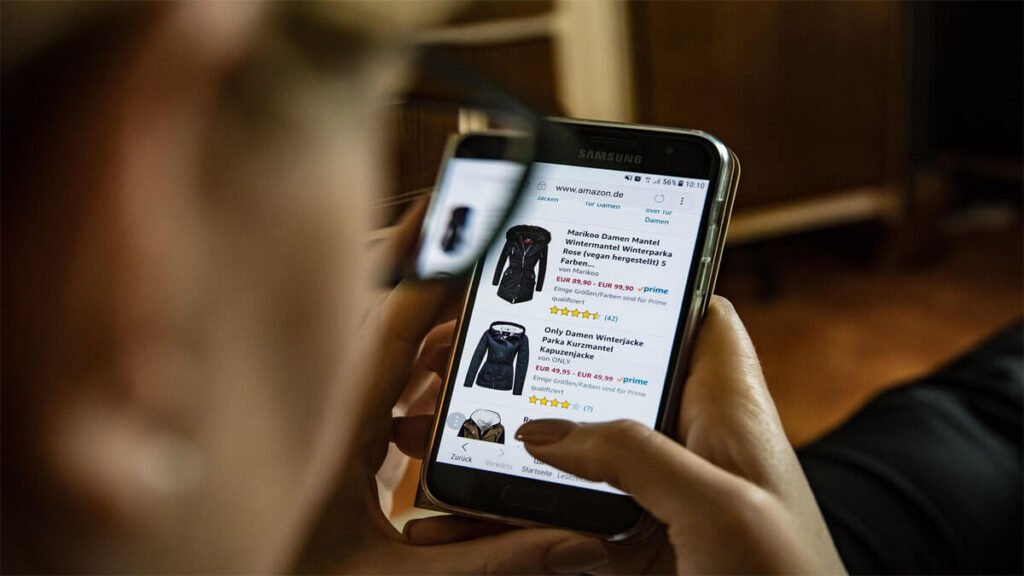

• Paying digitally and not noticing how fast money disappears

• Matching lifestyle with others instead of personal comfort

• Delaying savings because spending feels easier today

These bad spending habits may look harmless, but they slowly reduce the ability to save and create a feeling that money never stays.

Wasting Money

Wasting money is seldom a deliberate act. In other words, under normal circumstances, wasting money is an accidental, unconscious act, like throwing away subscribed services that remain unused, buying excessive things because of conveniences, changing things that are still in good condition, and so on. Because things happen very fast, wasting is an effortless act.

This eventually leads to confusion and frustration. People start wondering why savings do not grow even when income improves. This frustration sometimes pushes more emotional spending, which strengthens bad money habits further. Once wasting money becomes routine, it feels difficult to identify where change should begin.

Most Common Bad Money Habits

The most common bad money habits seem to be shared by most people in society, which may be why most people seem to be comfortable with them until faced with money woes. Knowing the most common bad money habits may help people stop blaming themselves and become aware of their habits.

Some of the most common bad money habits include:

• Not checking expenses and assuming things are fine

• Saving only if something remains at the end of the month

• Ignoring small daily expenses because they feel minor

• Spending based on feelings instead of intention

• Avoiding money planning because it feels uncomfortable

These most common bad money habits slowly build pressure and make financial confidence weaker over time.

Breaking Bad Money Habits

Breaking bad money habits does not change life suddenly, but it slowly creates relief. When spending becomes conscious, stress begins to reduce and money feels less confusing. Breaking bad money habits also allows savings to grow naturally, without extreme rules or sacrifice.

Some ways breaking bad money habits improves life include:

• Feeling calmer while making money decisions

• Less stress around monthly expenses

• More consistency in saving

• Better alignment between spending and values

• Gradual confidence about the future

Breaking bad money habits works best when progress is slow and honest.

How to Break Bad Money Habits

Learning how to break bad money habits starts with observation, not control. Many people fail because they try to change everything at once. Understanding how to break bad money habits becomes easier when attention replaces guilt.

Some simple ways to practice how to break bad money habits are:

• Noticing emotional reasons behind spending

• Setting flexible limits instead of strict rules

• Saving small amounts consistently

• Reviewing expenses without judgment

• Pausing before non-essential purchases

When people focus on how to break bad money habits patiently, change feels possible.

Conclusion

Bad money habits often grow from repeated bad spending habits and unnoticed patterns of wasting money. By becoming aware of the most common bad money habits and choosing breaking bad money habits over quick fixes, financial balance slowly becomes realistic. Learning how to break bad money habits is less about discipline and more about awareness over time.

FAQs

What is a bad money habit?

A bad money habit is a repeated behavior that slowly harms financial stability. It often develops without awareness and feels normal at first. Over time, it reduces savings and increases stress. Awareness helps bring control.

What is a bad spending habit?

A bad spending habit involves spending money in ways that do not support long-term comfort. It may include emotional purchases or ignoring expenses. These habits build pressure gradually. Recognizing them is important.

How to stop bad money habits?

Stopping bad money habits begins with noticing patterns calmly. Small changes, consistent saving, and emotional awareness help improve behavior. Progress feels easier when pressure is removed.